|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

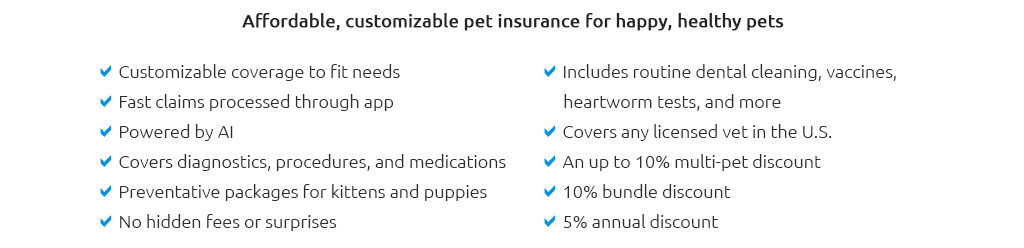

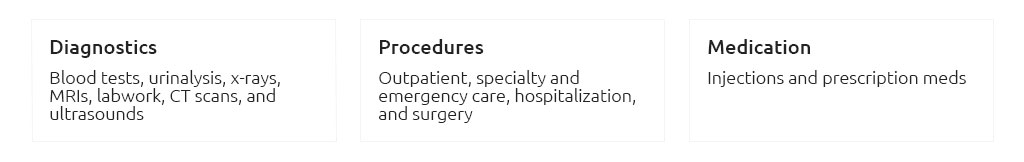

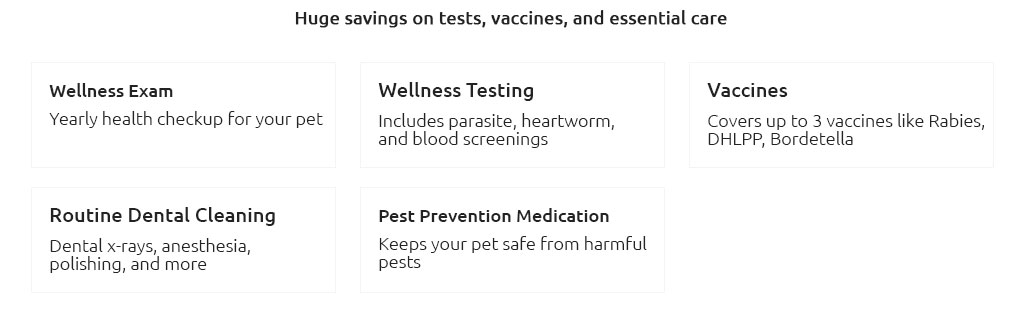

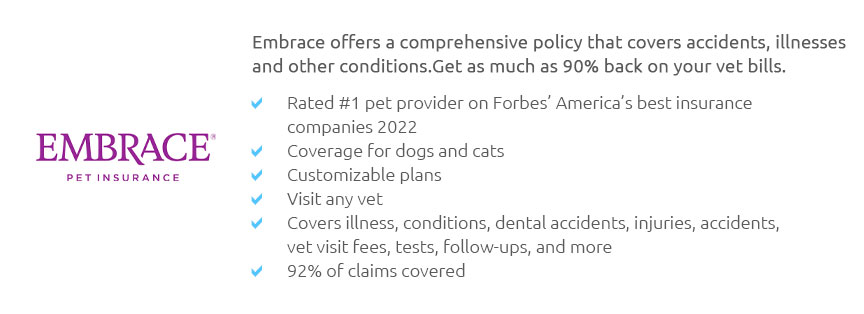

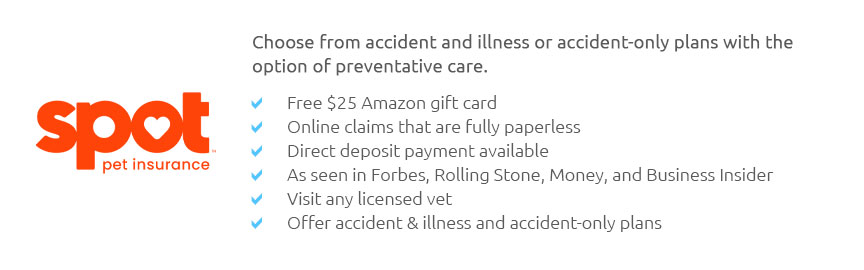

Pet Insurance for Sick Cat: Making Informed DecisionsUnderstanding Pet Insurance for CatsPet insurance for your sick cat can be a lifesaver when faced with unexpected veterinary bills. It provides financial protection and peace of mind, allowing you to focus on your pet's recovery. What Does Pet Insurance Cover?Most pet insurance policies cover a range of illnesses and accidents. Commonly covered conditions include:

However, it is crucial to review the policy details to understand what is specifically covered and any potential exclusions. Choosing the Right PolicyFactors to ConsiderWhen selecting a pet insurance policy for your sick cat, consider the following factors:

Additionally, it's wise to compare different providers and their offerings. For instance, understanding the pet insurance nc cost can provide insights into regional pricing variations. Age ConsiderationsAge can be a factor when obtaining pet insurance. Some insurers may have age limits for new policies, while others offer pet insurance no age limit options. This flexibility can be beneficial if your cat is older. Maximizing Your Pet Insurance BenefitsOnce you have a policy in place, use these tips to maximize your benefits:

Frequently Asked QuestionsIs pet insurance worth it for older cats?Yes, pet insurance can be worth it for older cats, especially if they are prone to age-related health issues. Policies without age limits can provide necessary coverage without excluding older pets. How can I get a lower premium?To get a lower premium, consider higher deductibles or customizing the coverage to meet your specific needs. Shopping around and comparing different insurers can also help find competitive rates. What should I do if my claim is denied?If your claim is denied, review the explanation provided by your insurer and ensure all documentation is accurate. You can appeal the decision if you believe there was an error. https://www.petmd.com/cat/general-health/insurance-cats

So, on average, cat parents pay about $350 annually for accident and illness, and $135 annually for accident-only. For wellness plans, you could ... https://www.progressive.com/pet-insurance/

Accidents and illnesses. Companion Protect and Pets Best offer plans that cover both injuries and illnesses, no matter how serious. These comprehensive plans ... https://www.allstate.com/pet-insurance/cat-insurance

Cat insurance could help cover medical costs if your cat is sick or injured. Keep your feline friends happy, healthy and purring with pet health insurance.

|